in Global Payroll Solutions and Employer of Record Services

TopSource Worldwide’s in-country experts help you hire and manage your international employees. Our in-country experts ensure all your international HR and payroll needs are taken care of through our end-to-end services.

Specialising in multi-country payroll solutions

- Real, knowledgeable people providing accurate employment advice

- Fast, responsive and reliable service with robust SLAs

- Supporting every step of the employee lifecycle - from hire to retire

Your guide to seamless global expansion

- Centralised account management with a single point of contact

- Access local HR & payroll experts in every location

- Onboard new global talent in days not weeks

Trusted advisors supported by technology

- A dedicated team of employment experts to take care of all your needs

- A single, global tech platform for all your hiring requirements

- Easy-to-use tech platform that integrates with your existing HR software

”With TopSource we were able to have employees hired or maintained in Nutreco without having to establish an entity in these countries for only 1-2 employees. I think most countries are covered by TopSource, so they can help us with almost all cases. Good advice on conditions and direct contact with employees. Invoicing done directly to the company. An easy process compared to hiring employees by ourselves.”

Annette van Duijnhoven

"We searched the market for a local payroll vendor in 2014 and we chose TopSource as our partner. We were looking for error free and timely payroll processing and TopSource Worldwide delivers this, saving us time and money. We have worked together for 8 years now and would recommend them to anyone.”

Praveen Lihinar

”TopSource Worldwide has a detailed and methodical onboarding process that made it easy for us to get set up and running with our UK employee. They were able to take the worry out of trying to comply with all local laws and regulations. Because they have this knowledge we do not have to research on our own and hope we are in compliance. This has saved us hours of time and gives both the company and employees a sense of security.”

Supervisor

”We’re thrilled to have helped create a dynamic new employment solutions group, backing a highly talented team in a high-growth market. Now we’re looking forward to helping the group grow even faster.”

Vice President of HR

Employ and pay anywhere, any way you want

Global EOR

Global EOR

Global & Local Payroll

Global & Local Payroll

Global Entity

Global Entity

Global Advisory

Global Advisory

Global EOR

Global EOR

Global & Local Payroll

Global & Local Payroll

Global Entity

Global Entity

Global Advisory

Global Advisory

Countries that we support

0+

0+

0+

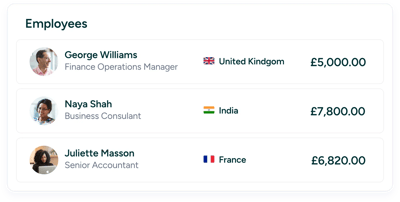

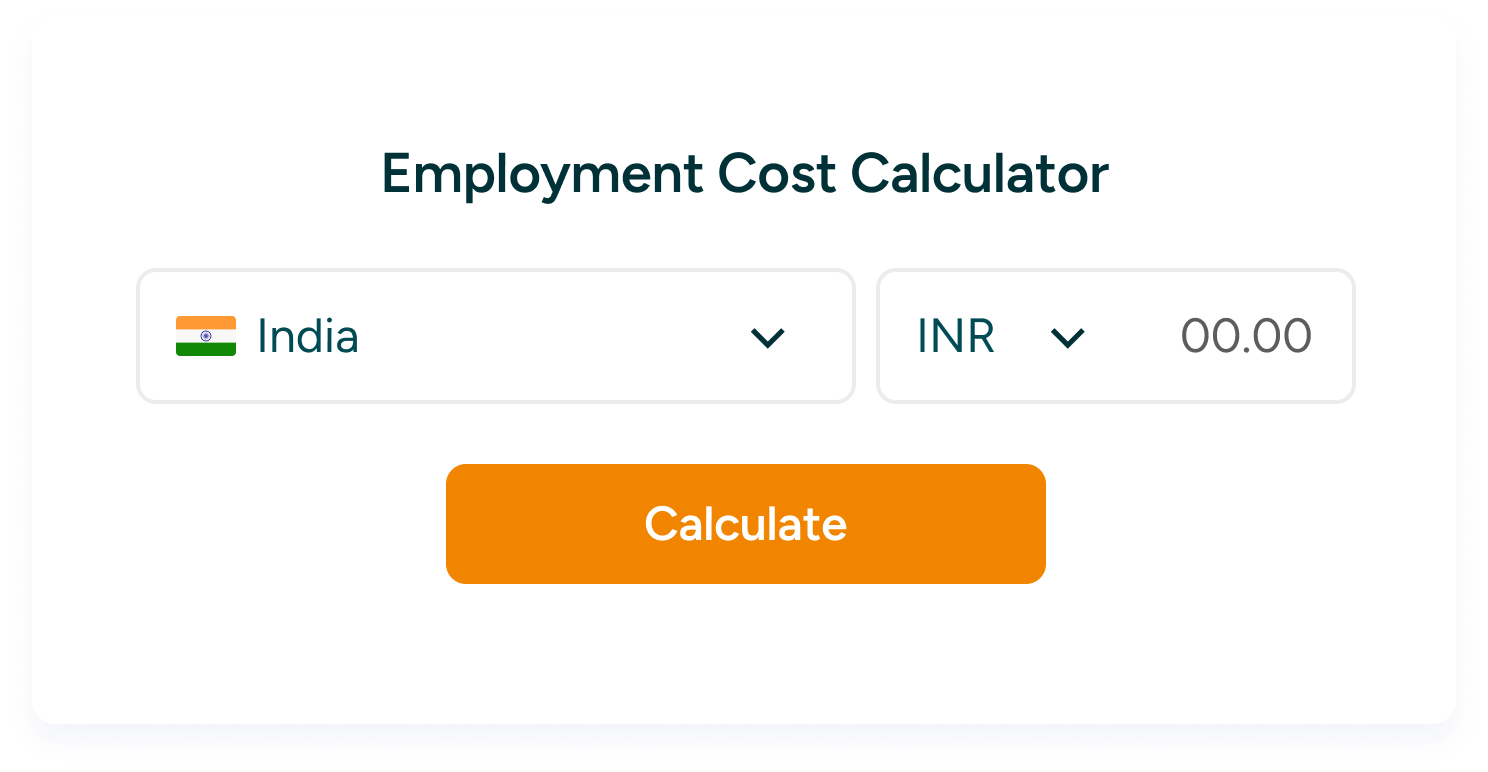

Employee Cost Calculator

Learn more about employing talent across the globe

Europe

Europe

North America

North America

South America

South America

Africa

Africa

Oceania

Oceania

Asia

Asia

Get in touch

Want to talk to us about your global employment needs?

Employing people internationally can be a daunting prospect, especially if you’re entering new countries for the first time. We can guide you through the whole process, step-by-step. Schedule a call with one of our experts today, and learn:

- What you need to get started

- The best international expansion options for your organisation

- What you can expect from an EOR & global payroll service

- Your role in the process from day one